Employees will be able to save more money in their health savings accounts (HSAs) in 2024, thanks to inflation-driven increases in contribution limits.

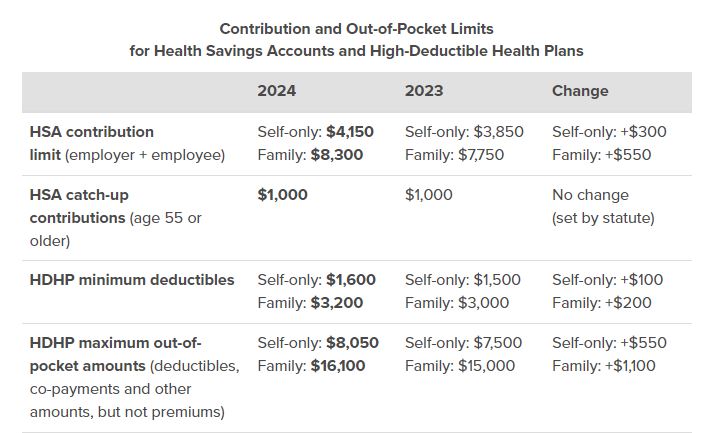

The IRS announced on May 16 that the annual limit on HSA contributions for self-only coverage will be $4,150, up 7.8% from $3,850 in 2023. The HSA contribution limit for family coverage will jump to $8,300, up 7.1% from $7,750 in 2023.

Participants 55 and older can contribute an extra $1,000 to their HSAs, for a total of $5,150 in 2024.

The IRS also announced that the minimum deductible for high-deductible health plans (HDHPs) will increase to $1,600 for self-only coverage and $3,200 for family coverage in 2024. Annual out-of-pocket expense maximums will also increase, to $8,050 for self-only coverage and $16,100 for family coverage.

The maximum amount that employers may contribute to an excepted-benefit health reimbursement arrangement (HRA) will also increase, to $2,100 in 2024.

These increases take effect in January 2024.

Here are some key takeaways:

- HSA contribution limits are increasing by 7.8% for self-only coverage and 7.1% for family coverage in 2024.

- Participants 55 and older can contribute an extra $1,000 to their HSAs.

- The minimum deductible for HDHPs is increasing to $1,600 for self-only coverage and $3,200 for family coverage in 2024.

- Annual out-of-pocket expense maximums are also increasing, to $8,050 for self-only coverage and $16,100 for family coverage.

- The maximum amount that employers may contribute to an HRA is increasing to $2,100 in 2024.

This is the first time that the HSA contribution limit for family coverage has exceeded $10,000, and the first time that the HSA contribution limit for self-only coverage has exceeded $5,000.

These increases are significant because they make HSAs even more attractive as a way to save for medical expenses. HSAs offer triple tax benefits: contributions are made pretax, the money in the accounts grows tax free, and withdrawals for qualified medical expenses are tax free.

In addition, HSAs can be used to pay for health insurance premiums in retirement, which can help retirees save money on their healthcare costs.

The HSA contribution limits are released every April or May by the IRS, ahead of other limits such as flexible spending accounts and 401(k) contributions. This gives employers and HSA administrators plenty of time to adjust their systems.

Employers often promote HSAs and encourage employees to boost their contributions during open enrollment. However, it would be a good idea for HR and benefits leaders to start that conversation now, as the new HSA contribution limits are sure to capture employees’ attention.

HSAs are a powerful tool for saving for medical expenses, and the new contribution limits make them even more attractive. Employees who are considering HSAs should talk to their employers or HSA administrators to learn more about how they can take advantage of these accounts.

NARFA continues to offer Health Savings Accounts as part of our exclusive members-only offerings. Please contact us to learn more about NARFA and our programs.

Recent Posts

The Hidden Cost of “Seeing Whoever:” In-Network vs. Out-of-Network Explained

Most of us pick a doctor the same way we pick a restaurant. We check the reviews, see if the location is convenient, and find [...]

UPDATED: Direct and Indirect Costs of Workplace Injury: Hidden Dollars Matter More Than You Think

When a workplace injury happens, everyone sees the obvious costs: the claim, the medical bills, maybe some time off. What most employers underestimate are the indirect and [...]

Focusing on the Long Haul: A Practical Guide to Driver Ergonomics and Injury Prevention

For professional drivers, the "office" isn't a cubicle, it’s the cab of a truck. While most safety discussions focus on what happens on the road, [...]